Mileagewise - Reconstructing Mileage Logs Can Be Fun For Anyone

Mileagewise - Reconstructing Mileage Logs Can Be Fun For Anyone

Blog Article

See This Report on Mileagewise - Reconstructing Mileage Logs

Table of ContentsThe Basic Principles Of Mileagewise - Reconstructing Mileage Logs 7 Simple Techniques For Mileagewise - Reconstructing Mileage LogsMileagewise - Reconstructing Mileage Logs Things To Know Before You Get ThisMileagewise - Reconstructing Mileage Logs Fundamentals ExplainedHow Mileagewise - Reconstructing Mileage Logs can Save You Time, Stress, and Money.Little Known Facts About Mileagewise - Reconstructing Mileage Logs.

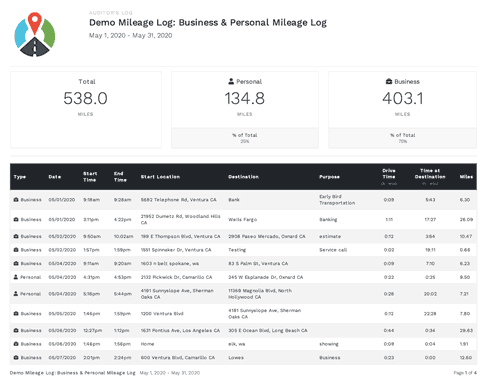

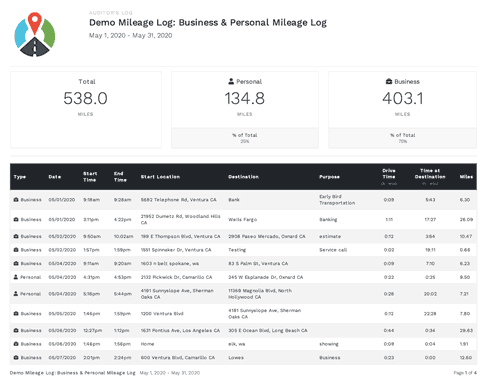

Staff members will not receive their reimbursements unless they send mileage logs for their company trips. Second, as previously specified, while manually taping gas mileage is an alternative, it's time consuming and reveals the company to mileage fraudulence.While a normal gas mileage reimbursement can be kept up hands-on gas mileage monitoring, a FAVR program calls for an organization mileage tracker. The reasoning is simple. FAVR compensations are certain to each specific driving employee. With the right company, these rates are determined through a platform that connects organization mileage trackers with the information that ensures reasonable and exact mileage repayment.

This confirms the allocation quantity they get, making sure any kind of amount they get, up to the Internal revenue service gas mileage price, is untaxed. This also secures business from prospective gas mileage audit danger., likewise referred to as a fleet program, can't potentially have demand of a service gas mileage tracker?

9 Easy Facts About Mileagewise - Reconstructing Mileage Logs Described

, "A worker's personal use of an employer-owned car is thought about a part of a staff member's taxed income" So, what takes place if the worker does not maintain a record of their business and personal miles?

A lot of organization gas mileage trackers will have a handful of these attributes. A smaller number will certainly have them all. That doesn't assure they provide each attribute at the same level of quality. It needs to come as no shock that mileage automation tops this listing. At the end of the day, it is among the most significant benefits a business gets when adopting an organization mileage tracker.

3 Simple Techniques For Mileagewise - Reconstructing Mileage Logs

(https://www.figma.com/design/5qkgS0W0lb9GSMsCAxlEAB/Untitled?node-id=0-1&t=xTFVnmLUZYrPDnRK-1)If the tracker permits staff members to submit insufficient gas mileage logs, after that it isn't performing as required. Areas, times, odometer document, all of that is logged without additional input.

Mobile employees can include this information any type of time before submitting the mileage log. Or, if they taped an individual trip, they can remove it. Sending mileage logs with a service gas mileage tracker ought to be a wind. When all the information has actually been included properly, with the very best tracker, a mobile worker can submit the gas mileage log from anywhere.

Facts About Mileagewise - Reconstructing Mileage Logs Uncovered

Can you visualize if a service gas mileage tracker application recorded each and every single journey? Sometimes mobile employees just neglect to turn them off. There's no damage in recording individual journeys. Those can quickly be erased before entry. Yet there's an also less complicated service. With the best gas mileage monitoring application, business can set their working hours.

Some Known Questions About Mileagewise - Reconstructing Mileage Logs.

This app works hand in hand with the Motus system to ensure the accuracy of each gas mileage log and repayment. Where does it stand in terms of the ideal mileage tracker?

Interested in learning more regarding the Motus application? Take an excursion of our application today!.

Mileagewise - Reconstructing Mileage Logs - The Facts

We took each app to the field on a similar route throughout our rigorous testing. We examined every monitoring setting and changed off the net mid-trip to try offline mode. Hands-on testing allowed us to take a look at usability and establish if the app was simple or tough for workers to use.

: Easy to useAutomatic mileage trackingMinimum tracking rate thresholdSegmented tracking Easy to produce timesheet records and IRS-compliant gas mileage logsOffline mode: Advanced tools come as paid add-onsTimeero covers our list, many thanks to its ease of usage and the efficiency with which it tracks mileage. You do not require to purchase expensive gadgets. Just demand employees to set up the mobile application on their iphone or Android smart devices which's it.

Report this page